Yes, cash is important. However, cash-flow is imperative! Do you find yourself always playing catch up financially? Do you seem to have more than enough cash some weeks and not nearly enough others? Are you constantly juggling your financial resources? But somehow you always seem to manage or just make it through? You’re not alone. And that can stop today!

Cash is important but cash flow is vital to the sustainability of your business!

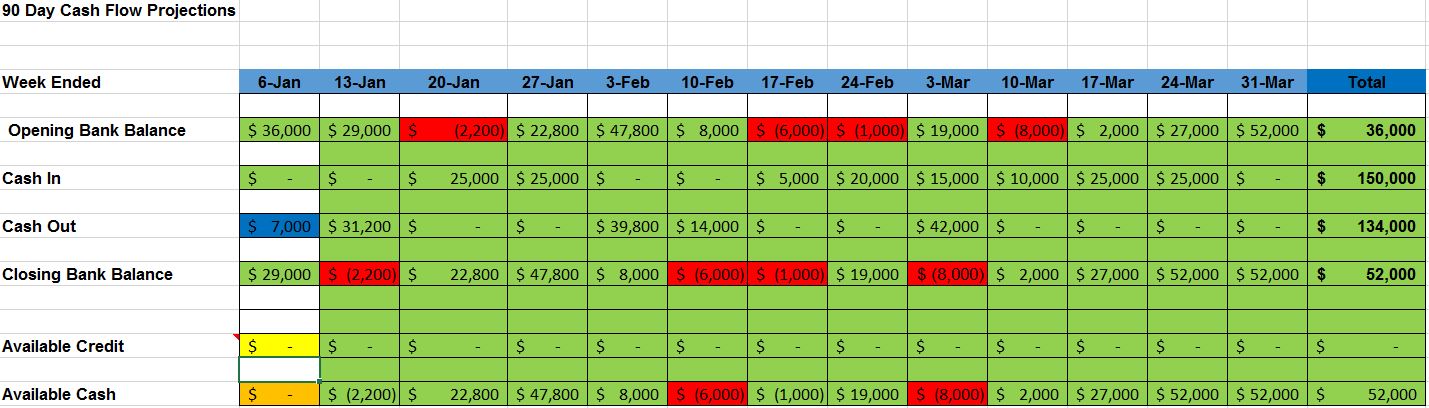

Would you consider a business that generated $150,000.00 in revenue, had expenses of $134,000.00 (including owners draw), with an 11% profit margin and net income of approximately $16,000.00 over a 90 day period to be a financially sound and successful business? Did you answer yes? You may be right. However, you may be very wrong. Many businesses fail, not because of cash, but because of cash flow.

This business while generating $150,000.00 in cash over 90 days, did not project cash-flow and ultimately almost closed it’s doors several times within the 90 days. Thankfully, the owners had family and friends that believed in their business and provided loans to fund the cash gaps. Otherwise, the show would have been over within 3 short months.

Let me give you a very high-level brief example.

Business A generates 2,500,000.00 per year. There expenses total 2,000,000.00 per year. Half a million dollars in profit sounds great. Doesn’t it? Think again. Let’s look at Business A again from a cash-flow perspective.

Business A Generates $280,333.00 per month, every month for 12 months ($2,500,000.00 in Gross Revenue). $2,000,000.00 of the expenses are paid by September 30th of each year. By September 30th the business has only generated $1,875,000.00. As a result, this company could be out of business by September. This is an extreme example. Most businesses have income and expenses throughout the entire year. However, break this into a weekly cash-flow scenario and we could end up with the same result.

You must project cash-flow for the health AND SUSTAINABILITY of your business. Sure, you can balance your accounts. You can calculate what income and expenses you have each month. You can review your P&L and Balance Sheet. But the bottom line is when cash comes in vs when cash goes out can make or break a company very quickly. You must project it weekly. Too often businesses project monthly. That’s not good enough. Let me show you why.

The example below is a prime example of the power of cash-flow, not cash.

This business generated $150,000.00 in cash over a 90 day period. Their expenses were only $134,000.00 for that same 90 day period of time. Again, if we were looking big picture the business looks profitable. However, look at cash flow on a weekly basis and the business probably won’t succeed. This business has such swings in cash flow that it’s sustainability without a line of credit or another form of working capital, or a means to manage their cash flow, is little to none. That’s the difference in balancing your books and projecting cash-flow.

Reviewing your balance sheet or P&L will give you a snapshot of the health of your business. However, it will not give the insight to the sustainability of your business!

If you want a sustainable, healthy, and profitable business projecting cash-flow is a must!

So, project, adjust, and project again. Then wash, rinse, and repeat! Understand the financial health AND sustainability of your business! Are you ready to start projecting but aren’t sure how? Get our free 90- Day Cash-Flow Projection Workbook by emailing me at ">!